What investment would work for you?

An investment is the purchase of an asset that generates future returns. In this way you are allowing your money to work for you. The market compensates investors for taking on higher levels of risk with potential higher returns.

There are four main asset classes you can invest in namely cash and cash equivalents, bonds, listed property and equities.

Cash or cash equivalents are highly liquid assets and their returns are earned in the form of interest rates, which compensates for the real value of the initial investment being eroded by inflation. The only risk to your initial capital is the credit risk associated with the holding bank.

Bonds are issued by a company or government and in exchange for foregoing your initial capital; the issuing company compensates you with regular interest payments as well as the total amount of your capital at the end of a time period. They are less volatile compared to equities and the return you earn is better than cash but it is still much lower than the return you get from equities. Bond investors are also exposed to the credit risk of the issuer (in the event that the issuer cannot repay the bond holder)

Listed Property values tend to rise and fall more slowly than stock and bond prices in line with fluctuations in real property prices and inflation. It delivers returns in the form of rental income and capital appreciation of building values. There are many property investments that are listed on the JSE and this provides relative liquidity as you can buy and sell listed property fund shares or REITs.

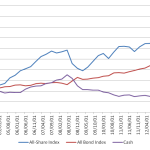

Equities (Shares) are the most volatile and riskiest asset class. Investors are compensated for assuming these higher levels of risk with higher potential returns. There is no guarantee of initial capital and instead the investor gains part ownership in a company and a claim on its future earnings. Historically they have outperformed other investments (NB past performance does not guarantee future results). The comparison between the returns on cash, bonds and equities is shown in figure 1 below.

Figure1. Comparison between returns on cash, bonds and equities (source: Inet Bridge)

2003=100(base year)

In choosing the right investment for you it is important to consider your time horizon, investment objectives and risk profile. At Thebe Stockbroking we will be able to assist you in determining the right investment for you based on these factors.

For further information please contact Rupert Fourie on 011 375 1082 or 082 454 7043.

(Article supplied by Thebe Stockbroking)